Using data driven reporting to extract more value from your data

Finance and Risk often work with their own systems and everyone queries the same data over and over. This is not just inefficient, it also leads to inconsistencies and data redundancy. Mismatches often occur because different data definitions are being applied.

Thanks to demands at the level of data quality and new regulations such as IFRS 17, the bottlenecks will become more pronounced.

Our approach

There is another way: by applying smart data management and collaboration between Finance and Risk you can be prepared for the future.

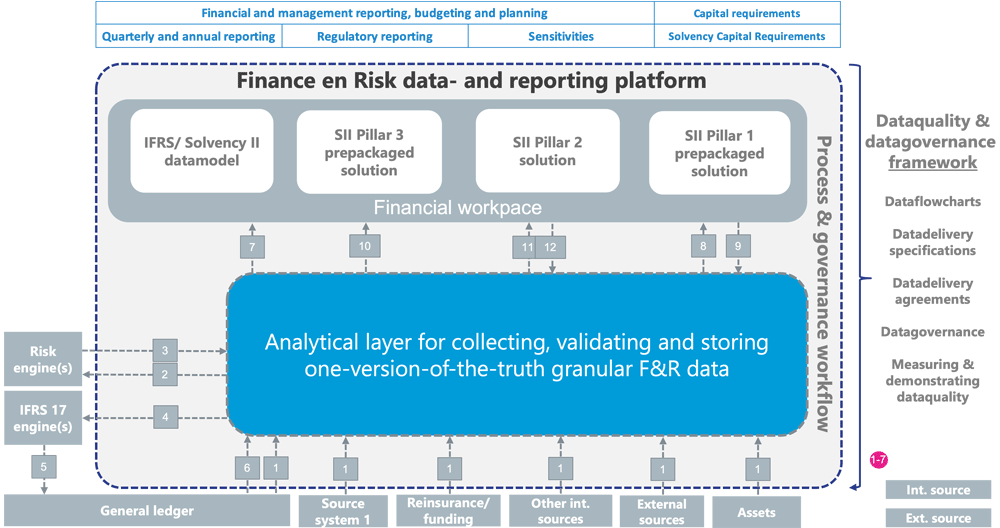

An example of an architecture with a central data store at a medium-sized insurance company.

The core of the solution is the central location where data is stored just once: a single source of truth. The data in the central store is re-used for the various different target processes further down the chain. This makes mismatches caused by different data definitions a thing of the past.

Many medium-sized insurance companies have already created a central data store. In many cases, Finance and Risk tend to work in the DWH using their own models, with the result that the data ends up being stored multiple time over, creating inefficiency and discrepancies.

Factors for success

When (re)creating a central data store you need to think carefully about the Finance and Risk data model. It has to be granular enough to be able to serve the different target processes in the chain. In addition, the timing aspects must be handled correctly. As well as the technology, the process is important. In order to gain time, it may be helpful to adjust the steps in the reporting process.

Important questions that must be asked during an (re)implementation are:

- How do you achieve a uniform Finance and Risk data model?

- What kinds of tools to use for the central data store?

- What are the most important requirements on these tools?

- What functionality will you need to create yourself, and which would you do better to buy in from a vendor?

- What are the data streams you need to create?

- Which process steps occur in the general ledger, the central data store and in the reporting package?

- Where do the various different validations need to take place?

- How will you handle corrections to the data, where will these occur?

How can we help?

We can help with:

- Defining the Finance and Risk data model

- Setting up the requirements for the central data store using worked examples

- Design of architecture, data store and data flows

- Implementing a new, or streamlining an existing central data store

- Change / project management

Read more here about our vision and approach to data driven reporting.

Why Sofia Consulting?

- We specialise in streamlining finance and risk reporting

- Combining in-depth financial and actuarial knowledge with knowledge of regulations and available tools.

- Pragmatic approach.

- Many examples that can be used to hit the ground running.