A practical approach for IFRS 17

Yes, IFRS 17 is complex and you definitely need to think hard about how you are going to prepare for it. But try above all to tackle it practically, and re-use the knowledge that you already have available in-house. With this attitude, we have helped a large number of insurance companies, both in the Netherlands and elsewhere, to become Solvency II compliant, and we support all insurers in the Netherlands who have to deal with IFRS with the introduction of IFRS 17. In the meantime, we have also become involved in a number of IFRS 17 implementations in other countries.

How can we help?

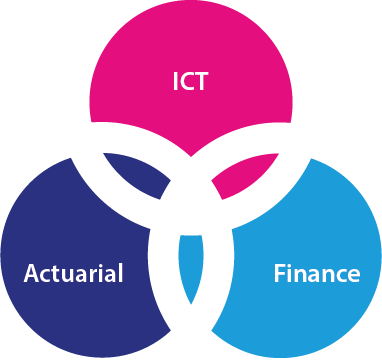

We combine in-depth knowledge of IFRS 17, actuarial and financial knowledge, and experience of implementing/streamlining IT systems.

This combination is, we believe, crucial to the successful translation of complex IFRS requirements into functional and practical solutions.

Examples of the services we can provide:

- Defining the actuarial requirements for setting up CSM

- Defining IFRS 17 accounting events

- Implementing a CSM engine (Tagetik)

- Implementing an accounting hub (Tagetik)

- IFRS 17 project management

- Preparing a consolidation and reporting system for IFRS 17

- IFRS 17 test planning, coordination

- IFRS 17 Finance and Risk architecture

Some examples of the roles we can play:

- IFRS 17 business analyst

- IFRS 17 test coordinator

- IFRS 17 project or programme manager

- Tagetik consultants for the implementation of the CSM engine/Accounting hub

- Actuarial and Financial specialists with experience in IFRS 17

During our projects we have acquired enormous experience in the introduction of IFRS 17. We regularly organise knowledge events where we share our knowledge with potential clients. Read more about our experience and best practices on our publication page.

Why Sofia Consulting?

Time is marching on, for a complex subject like IFRS 17 you need to work with someone who knows what you need without lengthy explanations. Someone who has the practical experience to build the links between Finance, Risk and IT. That is important, because the small group of experts within your organisation need to do it, and there is no time to be lost.

In practice we often work successfully alongside the Big-4. In this case, the big-4 accountancy company will often take on the role of expert advisor, while we take on the practical work of creating processes in practice, with the necessary IT and operational support. In this way, you get the ideal mix of expertise and experience in-house, giving you the confidence you need and preparing you cost-efficiently for IFRS 17.